So we have heard all the bells and whistles about Bitcoin and how it has changed the world and why cryptocurrencies are the potential future of money. However, the fact of the matter is that all those utopian promises that crypto proposes, come with quite a bit of string attached that most of us are, naively so, rather ignorant towards.

If cryptocurrency is indeed the future of money, then we need to make sure that the future it is going to leave us with does not fall in the hands of the wrong people i.e. criminals and hackers. In this article, we are going to try to explain how criminals use Bitcoin and other cryptocurrencies in order to launder dirty money i.e. money laundering.

Let’s first learn what money laundering is.

What is Money Laundering?

Money Laundering is the illegal process of hiding the origins of money obtained via criminal activity such as drug trafficking or terrorist funding and passing it through a complex chain of banking transfers to make it appear to have come from a legitimate source.

As the name suggests, the dirty money is “laundered” in the process and made to look clean after having passed through a chain of complex banking transactions – thus making it difficult for an MLRO (Money Laundering Reporting Officer) to track down the original source and report the crime.

Use of Crypto for Money Laundering

Money laundering isn’t news. It’s been done for ages and via numerous mediums like gold, cash, and now cryptocurrencies. Since Bitcoin is so high in value in comparison to the US Dollar, it is seen (foolishly so) as one of the best ways by criminals to launder large amounts of dirty money.

According to a report, criminals laundered over the US $2.8 billion via crypto exchanges in 2019, as compared to US $1 billion in 2018. Additionally so, about US$829 million worth of Bitcoin has been spent on the dark web, amounting to over 0.5% of all Bitcoin transactions.

But if cryptocurrency is subject to such criminal activity, why is it not globally banned yet? The reason is quite simple, actually. A cryptocurrency is merely a tool – just like fiat money. It is not inherently “bad.” It is simply a medium of exchange; how you use it determines the outcome, either good or evil.

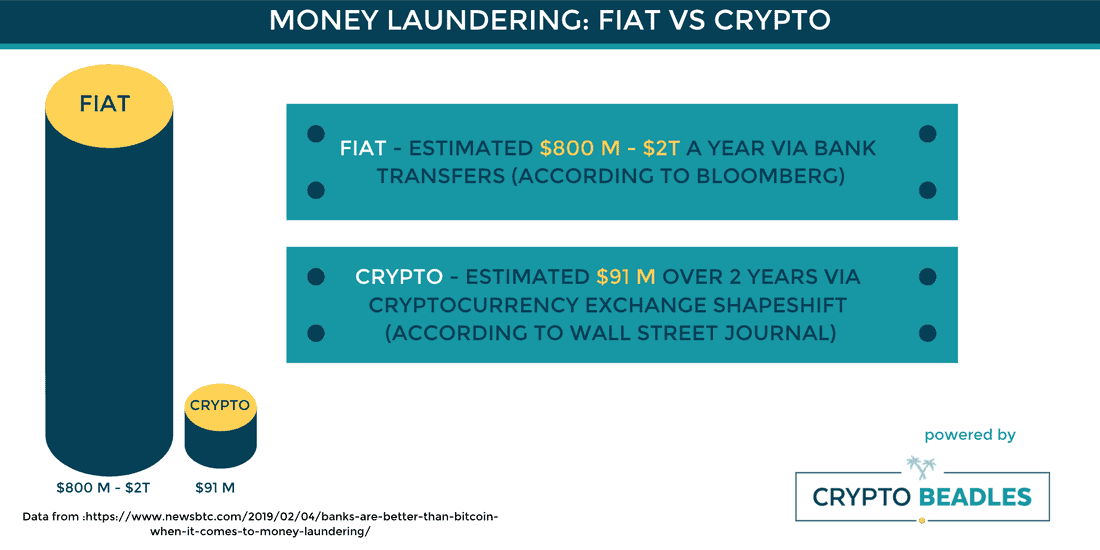

As a matter of fact, crypto is actually less responsible for money laundering compared to regular fiat money. One of the biggest reasons for that is because crypto, generally speaking, offers greater levels of accountability and security of transactions.

Why? Let’s take a look.

What exactly is Cryptocurrency?

Cryptocurrencies, like Bitcoin, are decentralized virtual currencies that have no physical existence and are built on mathematical code referred to as blockchain technology. Unlike fiat money, cryptocurrencies are not controlled or regulated by any central government body – allowing for the distribution of control.

Cryptocurrencies are a scarce asset having limited availability, just like gold. For instance, there are about 21 million Bitcoins in existence, out of which, nearly 88% have already been “mined” and are currently under circulation. Once all the Bitcoins are mined, no more can be extracted any further and the prices will most likely stabilize.

However, mining Bitcoins is an incredibly energy-inefficient process in today’s time. For early adopters, Bitcoin mining was an incredibly lucrative source of income – earning about 50 BTC every 10 minutes. However, the same is not applicable today because as more and more Bitcoins are mined, it becomes harder and harder to mine even more as it requires more computing power.

An average person trying to mine Bitcoin today may even incur more expenses from their electricity bill and depreciation of equipment rather than earning revenue from mining Bitcoins. There are companies that exist solely for Bitcoin mining using powerful ASICs (Application-Specific Integrated Circuit miner) – a device that is designed solely for the purpose of mining digital currency.

How Crypto works?

Apart from its decentralized nature and limited supply, what makes cryptocurrency different and more secure from fiat money is the fact that crypto transactions are transparent and immutable in nature – thanks to the blockchain technology that they are built on top of.

What that essentially means is that crypto transactions made on the blockchain technology are fully transparent and trackable. You can quite literally track every single Bitcoin exchange ever made in history by searching for the transaction address online.

What’s better is that these transactions are not alterable by any external third party. Once a transaction is made, it is linked to other transactions and bundled together as a “block.” Every new block is then linked together with the existing blocks, making a chain-like structure. Hence, the blockchain.

Suppose a criminal wants to make alterations in a transaction they made. For that to happen, they will have to alter all the subsequent blocks linked to the block containing their transaction, which is pretty much close to impossible.

But here’s the catch:

Even though the transactions themselves are secured through cryptography and cannot be altered which allows for great record-keeping, the fact that cryptocurrency is pseudonymous gives a major advantage to money launders since it allows them to mask their identities with relative ease.

How the Cryptocurrency industry combats Money Laundering?

Since there are no real ways for money launderers to cash out the cryptocurrency they’ve received through illegal activity without being spotted, they have much fewer incentive to keep doing so because crypto is not yet accepted as a standard medium of exchange for most industries.

The way to combat crypto money laundering starts with increasing compliance. Fortunately, the crypto industry has started working with law enforcement agencies, regulators, and crypto businesses to fight money laundering. Most large exchanges such as Binance and Houbi are already collecting KYC information on their customers.

Furthermore, Bitcoin ATM vendors are now required to identify and track the person who transacts with Bitcoins through their systems. All of this and more is being practiced in order to make crypto a safe market for everybody and comply with legal frameworks in various countries implementing AML (Anti-Money Laundering) requirements as necessary.

Cryptocurrency, in its entirety, has a bright future ahead despite all the mentioned drawbacks. Through increased compliance and regulatory bodies working to report crypto-based illicit activities, the general public can be rest assured to transact and invest in crypto safely.

Leave a Reply