The popularity of online payments keeps growing.

Long gone are the times when people were reluctant to trust e-commerce websites. Today, online payments are more secure and flexible, which brings more freedom to those who like to shop from home.

Among the most preferred payment methods, credit and debit cards take the leading position, followed by PayPal and AliPay, Visa Checkout and Masterpass:

Image credit: Statista

Image credit: Statista

The most ‘cashless’ generations are millennials and Gen Z consumers – only 33% of millennials and 13% Gen Z report using cash on a daily basis. Baby Boomers are still lagging behind, with only 18% of representatives of this generation showing interest in online payments.

Such immense support of online payments pushes this segment to rapid growth. According to Vapulus, global online transactions will reach more than $4 trillion by 2023. With growing consumer interest in online payments, companies are constantly looking to invest in technologies that will improve the security and privacy of online payments.

Moreover, one of the key objectives of online businesses is to find technology that will optimize and increase the speed of online payments.

You, however, can already take a few steps in that direction right now by following these tips.

- Benefit from Autofill

Most people, when they are at the process of payment checkout, already know all the information that is required from them. So having your regular customers fill in the payment details every time during checkout will only make the checkout procedure longer.

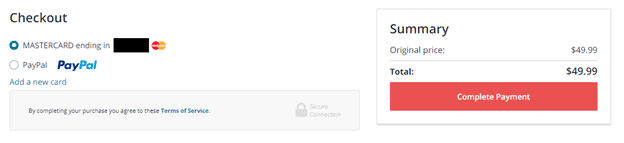

Udemy, an online education platform, allows autofill option for all their regular users during the purchase of a course:

You can also allow payment information autofill for mobile applications to speed up the payment process:

Autofill allows your customers to finish their payment in a matter of seconds instead of wasting time getting their wallet and entering the credit card details every time. “Our research has shown that only 20% of people can memorize their credit card details”, says Claire Johnson, a customer support specialist at Flatfy.

Using payment autofill will also help you decrease cart abandonment rates and secure a complete payment follow-through.

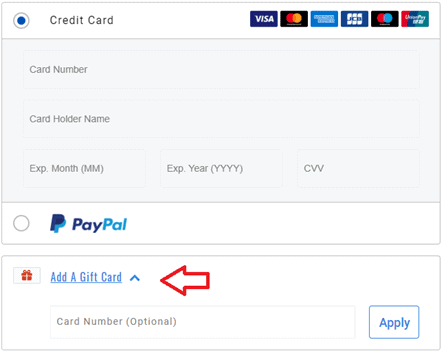

- Diversify Payment Methods

Another reason why the payment process may slow down is because your website doesn’t offer enough payment methods. The majority of online businesses concentrate on credit card payments and payment systems like PayPal or AliPay.

As a result, some of your potential customers may postpone the payment because they don’t have access to these payment methods at the moment of the checkout.

In this case, you should introduce several alternatives, like Visa Checkout, Masterpass, Apple Pay, or Google Pay. They aren’t as popular as credit cards or PayPal (you can check out their popularity on the stats at the beginning of the article). Nevertheless, there is a considerable percentage of people who’d prefer these payment options because they speed up the payment process.

Here’s an example of a website adding an option of a gift card payment along with a credit card and PayPal methods:

You also don’t have to worry about the security of other payment methods. MasterCard, for instance, has recently invested in online payment security to speed up the payment process and improve user experience.

- Exclude Redirecting

It is a common practice for online businesses to redirect payments if they use online payment services like PayPal. To complete the transaction, a buyer is redirected to PayPal’s website to complete the transaction. The same works for online payment services like AliPay and LiqPay.

While these online payment services are safe to use both for the business and the customer, they may affect the speed of the payment process.

The majority of concerns may come from people who don’t completely trust online payment systems and are suspicious about having to enter a different website to complete payment. This can result in a growing number of abandoned carts and less trust in your business.

Apart from that, many people have an issue with redirecting during the payment process because it raises the question, who to contact if payment issues occur.

What should you do in this case?

Offering a variety of payment methods would be the best solution. Shopping experience should be as comfortable as possible for your customers, so to speed up the payment process, they should be able to effortlessly switch between different payment options.

Simplify the Payment Process Today!

Customers, too, get frustrated when the payment process takes too long, which also has a negative impact on their user experience. But luckily, there are some things you can do to make this process more effortless for your customers.

Hopefully, the tips we shared with you in this article will help you diversify the payment process and make it faster for your customers to purchase the product.

Leave a Reply