During 2019, Australians reported 167,797 scams to a Scamwatch regulated by the Australian Competition and Consumer Commission (ACCC).

The financial impact for Australians in 2019 was just over AU$634 million , an increase of 34 per cent over the previous year. This represented an total loss of AU$7,224. Scamwatch Targeting scams 2019: A review of scam activity since the 2009 report [PDF] showed that a financial loss included only 11.8 percent of scam reports.

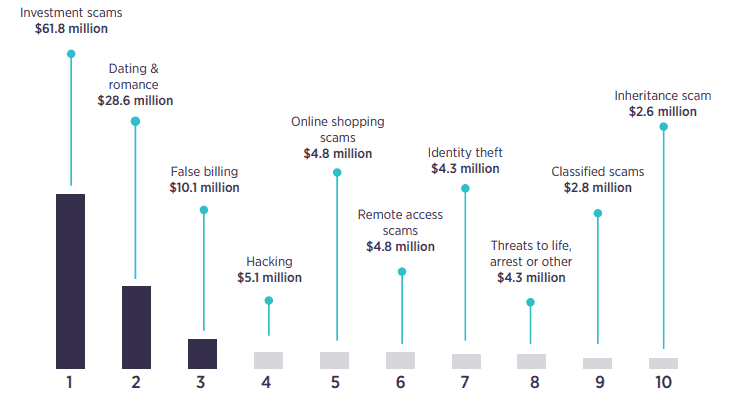

The largest losses by form of scam in 2019 were: AU$132 million to business email breach (BEC) scams, AU$126 million to investment scams, and AU$83 million lost to relationship scams and dating.

Phishing was the most common scamming tool in 2019, with 25,168 posts. Of those reported, 513 resulted in a financial loss of 1.5 million AU$.

Theft of identities came in third with 11,373 incidents and 562 of those resulted in a loss of just over AU$4.3 million. There were 9,019 remote access scams, of which 682 cost Australians AU$4.8 million; and 8,321 times “hacking” as a scam form, with 509 resulting in a loss of AU$5.1 million.

Reported losses for crypto-currency scams in 2019 out of 1,810 cases reached AU$21.6 million.

“Cloud mining farms have been a common adaptation of this kind of scam. Many of them were Ponzi schemes, with no actual cryptocurrency involved,” explained the study.

Scamwatch said Australia struck last year by an international Ponzi cryptocurrency scam — USI Tech —. It has received more than 200 reports on USI Tech, with losses of AU$3.3 million, mostly through Bitcoin.

The top two forms of payment for scams in 2019 were AU$70 million bank transfers, and AU$19 million Bitcoin.

Those aged 55-64 experienced the highest overall loss, and the age bracket that recorded the most scams was aged 65 and over, followed by those aged 25-34. 18-24-year-olds accounted for only four per cent of overall losses. People between the ages of 55 and 64 have lost almost 30 million AU$.

Men were the most fooled by investment scams, and women by romance scams and dating.

Phone remains the key route for scamming, with 69,522 reports; followed by emails with 40,277 reports; text messages with 27,894 reports; and the scam tool for 11,776 reports was “the internet.”

AU$32.6 million was lost over the phone, and “the internet” saw victims losing AU$31.6 million despite only being responsible for 7 percent of the total scams.

“Unfortunately there are massively understated financial losses to scams,” said Delia Rickard, chair of the ACCC.

“Scammers have switched to unexpected victim targeting sites. In 2019, for example, we saw dating and relationship scammers targeting unsuspecting victims through gaming apps like Words With Friends and investment scammers targeting Facebook and Instagram users with ‘get rich fast’ crypto-currency investment scams.”

Losses to scams of text messages increased by 40% in 2019, at just under AU$97,000, despite just 9% more reports. Many of these were phishing scams that impersonated banks, myGov, Australia Post and JB Hi-Fi, the report revealed.

Social media fraud have rose in 2019: social networking contacts increased by 20% and mobile device contacts by 29%.

Companies reported 5,904 scams to Scamwatch in 2019, with losses of more than AU$5.3 million. The largest losses were incurred by bogus billing fraud, at AU$2.7 million.

The most financially damaging BEC schemes involved invoices that are intercepted and amended with false banking information between firms, suppliers or individuals. The report showed businesses were targeted mostly by scammers impersonating senior managers, employees and suppliers.

In 2009, the ACCC published the first report on Targeting scams, and released 11 to date.

Looking back, Australians reported losing AU$2,5 billion to scams between 2009 and 2019, the study found. In 2009 Scamwatch reported losses totalling AU$69.9 million.

Unsurprisingly, technological advances over the past decade have contributed to the proliferation of the scams that impact Australians.

“While most scams remain fundamentally the same as in 2009, many have adapted over time to use social media, new methods of payment, and online services to either source new victims or legitimize their stories,” adds the report.

“New schemes have also arisen, such as company email vulnerabilities and cryptocurrency investment scams. These are also among Australians’ most financially crippling scams.”

In July 2019, ReportCyber replaced ACORN as the online reporting portal for cybercrime by the Australian Government.

The new study of the ACCC contained first-time data from the Big Four banks — ANZ Bank, Australia’s Commonwealth Bank, Australia’s National Bank, and Westpac.

Leave a Reply