Introduction to PCI Compliance

In the digital age, where online transactions are ubiquitous, safeguarding sensitive payment card data is of paramount importance. PCI Compliance, short for Payment Card Industry Data Security Standard, is a set of security standards established to protect cardholder information and prevent data breaches. Businesses that handle credit card transactions are obligated to comply with PCI DSS to ensure the safety and security of customer data.

PCI DSS Requirements

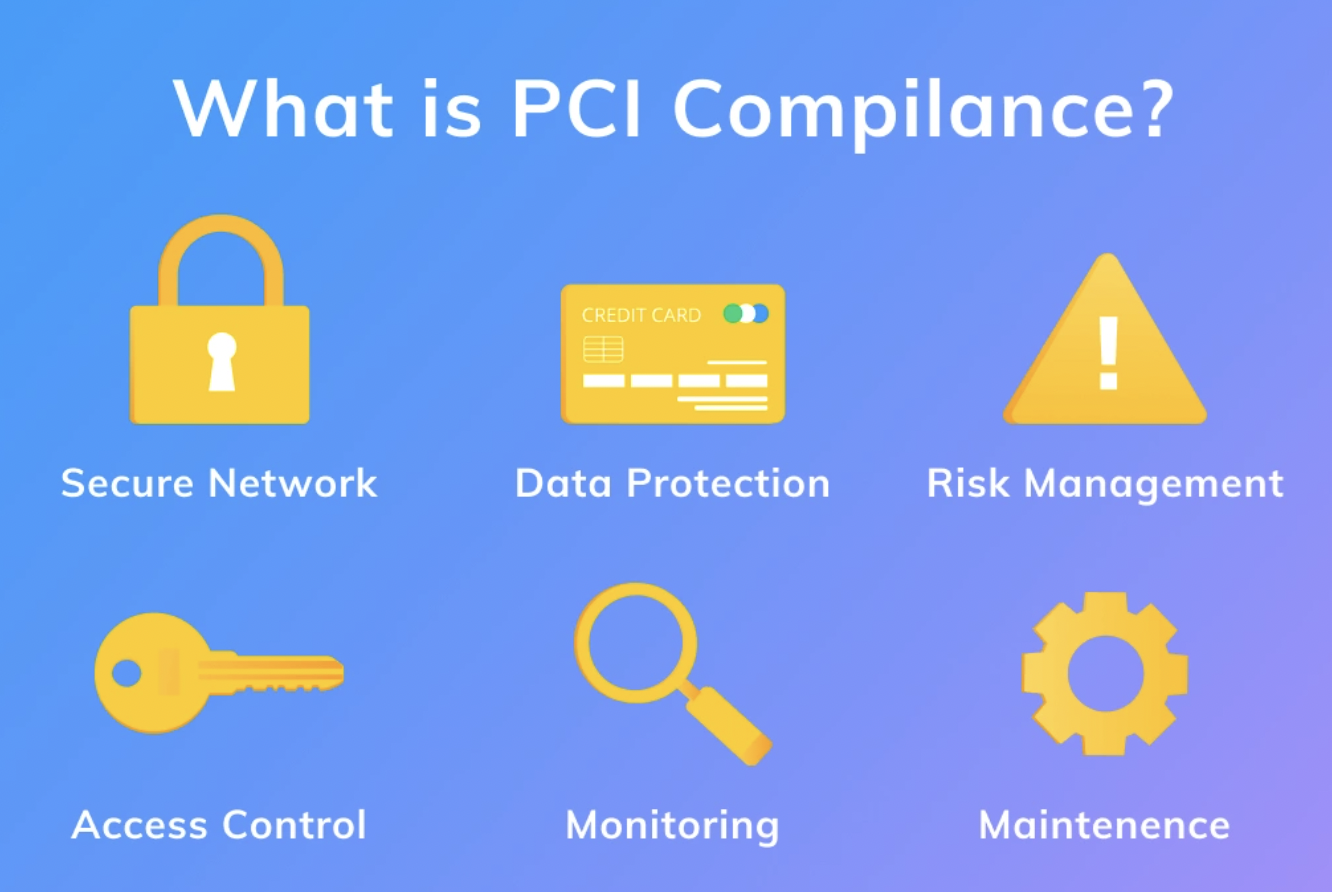

The PCI DSS compliance comprises twelve main requirements, organized into six overarching goals. These goals are designed to enhance data security and reduce the risk of fraud. Each requirement outlines specific measures that businesses must implement to achieve compliance.

PCI DSS Requirements: The Key to Securing Your Business

The Six Goals of PCI DSS are:

- Build and Maintain a Secure Network

- Protect Cardholder Data

- Maintain a Vulnerability Management Program

- Implement Strong Access Control Measures

- Regularly Monitor and Test Networks

- Maintain an Information Security Policy

How PCI Compliance Affects Businesses?

Benefits of PCI Compliance

PCI Compliance is not just a regulatory burden; it also offers several benefits to businesses. By adhering to these standards, companies can gain trust and confidence from their customers. A secured payment environment fosters customer loyalty and reduces the likelihood of data breaches and associated financial losses.

Consequences of Non-Compliance

Failure to comply with PCI DSS can lead to severe consequences. Fines, penalties, and the loss of the ability to process credit card transactions are some of the potential outcomes. Moreover, a data breach resulting from non-compliance could lead to a damaged reputation, loss of customer trust, and costly legal actions.

Steps to Achieve PCI Compliance

To become PCI compliant, businesses must follow specific steps:

Self-Assessment Questionnaire (SAQ)

The SAQ helps businesses self-evaluate their compliance level. It comprises a series of questions related to the handling of cardholder data and the security measures in place.

External Security Assessments

Larger businesses may need to conduct annual external security assessments, such as penetration testing and vulnerability scanning. These assessments provide an independent evaluation of their security measures.

Remediation and Reporting

If any vulnerabilities or non-compliance issues are identified during the assessments, businesses must address and rectify them promptly. Compliance reports need to be submitted to acquiring banks or payment processors.

Common Misconceptions About PCI Compliance

Despite the importance of PCI Compliance, several misconceptions prevail. Let’s debunk some of the common myths and reveal the reality.

The Future of PCI Compliance

As technology evolves, so does the threat landscape. The future of PCI Compliance will likely witness the integration of innovative technologies to strengthen security measures further.

PCI Compliance for Small Businesses

Implementing PCI Compliance may appear daunting for small businesses with limited resources. However, there are simplified approaches and resources available to cater to the needs of SMEs.

Tips for Maintaining Ongoing Compliance

PCI Compliance is an ongoing process, not a one-time task. Implementing regular security updates, conducting employee training, and maintaining awareness are crucial for sustained compliance.

Understanding Data Breaches and How to Prevent Them

Data breaches have become increasingly prevalent in recent years. Understanding the potential impact of data breaches and adopting best practices for data security is vital for all businesses.

The Role of Payment Processors in PCI Compliance

Payment processors play a significant role in ensuring PCI Compliance. They must adhere to specific responsibilities to maintain a secure payment ecosystem.

Global Regulatory Variations in PCI Compliance

Different regions may have specific regulatory variations regarding PCI Compliance. Businesses operating internationally must be aware of these differences.

Challenges Faced During PCI Compliance Implementation

Achieving PCI Compliance can present various challenges for businesses, such as resource constraints and complex technical requirements. Understanding these challenges can help overcome them effectively.

Case Studies of PCI Compliance Success Stories

Numerous businesses have benefited from PCI Compliance. Analyzing success stories can provide insights and inspiration for others striving to achieve compliance.

PCI Compliance and E-commerce

E-commerce businesses handle vast amounts of sensitive data. They must pay special attention to PCI Compliance and tailor their security measures accordingly.

Conclusion

PCI Compliance is not just a legal obligation; it is a crucial aspect of maintaining customer trust and data security. By adhering to PCI DSS requirements, businesses can create a safe payment environment, protect customer data, and prevent devastating data breaches. Embracing PCI Compliance as a proactive approach can lead to a more secure and reliable payment ecosystem, benefitting both businesses and consumers alike.

FAQs

Question: What is PCI Compliance?

Ans: PCI Compliance refers to the adherence to the Payment Card Industry Data Security Standard (PCI DSS), a set of security standards established to protect cardholder information and prevent data breaches.

Question: Who needs to comply with PCI DSS?

Ans: Any business that handles credit card transactions, including merchants, service providers, and financial institutions, must comply with PCI DSS.

Question: What are the consequences of non-compliance?

Ans: Non-compliance with PCI DSS can lead to fines, penalties, loss of the ability to process credit card transactions, and reputational damage.

Question: Is PCI Compliance a one-time task?

Ans: No, PCI Compliance is an ongoing process. Regular security updates, employee training, and awareness are essential for maintaining compliance.

Question: How does PCI Compliance benefit businesses?

Ans: PCI Compliance enhances customer trust, reduces the risk of data breaches, and fosters a secure payment environment, leading to increased customer loyalty.

FIND US ON SOCIALS